ROOM

29

Astronautics

Space invaders

Also known as ‘aliens’ or ‘barbarians’ [3], these

companies do not belong to the regular crowd of

the ‘space club’. They have their own rules, coming

mainly from the IT world and are fast and agile,

with a fresh look on entry barriers.

Several private companies have emerged, first

in the US and now in Europe and worldwide, such

as Satellogic in Argentina [4] and NorStar Space

Data in Canada. Their ambition is to develop

and operate space systems and services with

disruptive commercial objectives.

Rise of NewSpace

These firms bet on low-cost technology to provide

more affordable space systems and services based

on EO data. The massive use of high-performance

commercial off-the-shelf (COTS) technologies

has already proved the feasibility of constellations

of several tens of cubesats weighing around 5 kg

and costing a few thousands of dollars per unit.

But NewSpace is not always orientated to ‘small is

beautiful’ - some initiatives are based on medium-

sized or even large satellites.

The big players of the web sphere are

increasingly interested in space and able to

invest massively. With a huge cash capacity, their

assumption is the disruption will be triggered by

the convergence between advanced information

technologies and EO: in June 2014 Google

surprised space remote sensing experts and

traditional players when it bought Skybox Imaging

for US$500 million.

NewSpace actors have scalable business models

(i.e. the capacity to start business before the full

deployment of the system). They believe they

can lower or break the market entry barriers.

They target the final user in a B2C (business

to consumer) approach with aggressive and

agile solutions. ‘Democratising’ access to space

imagery is usually a key element of their business

strategy. Nearly all promote information freshness,

apps or web platforms, data analytics tools and

subscriptions via the Internet.

Space nations

Whether they are veterans in space activities

(China or India) or newcomers deciding to have

their own EO capacities, more and more nations

are becoming active players in EO. This affects

both the competition and the accessible market.

For example, since mid-2016, SI imaging Services

(South Korea) has been distributing VHR imagery

(GSD <50 cm) acquired by Kompsat-3A. Another

New Space

is not always

orientated

towards ‘small

is beautiful’

High resolution on

small satellite: like

squaring the circle.

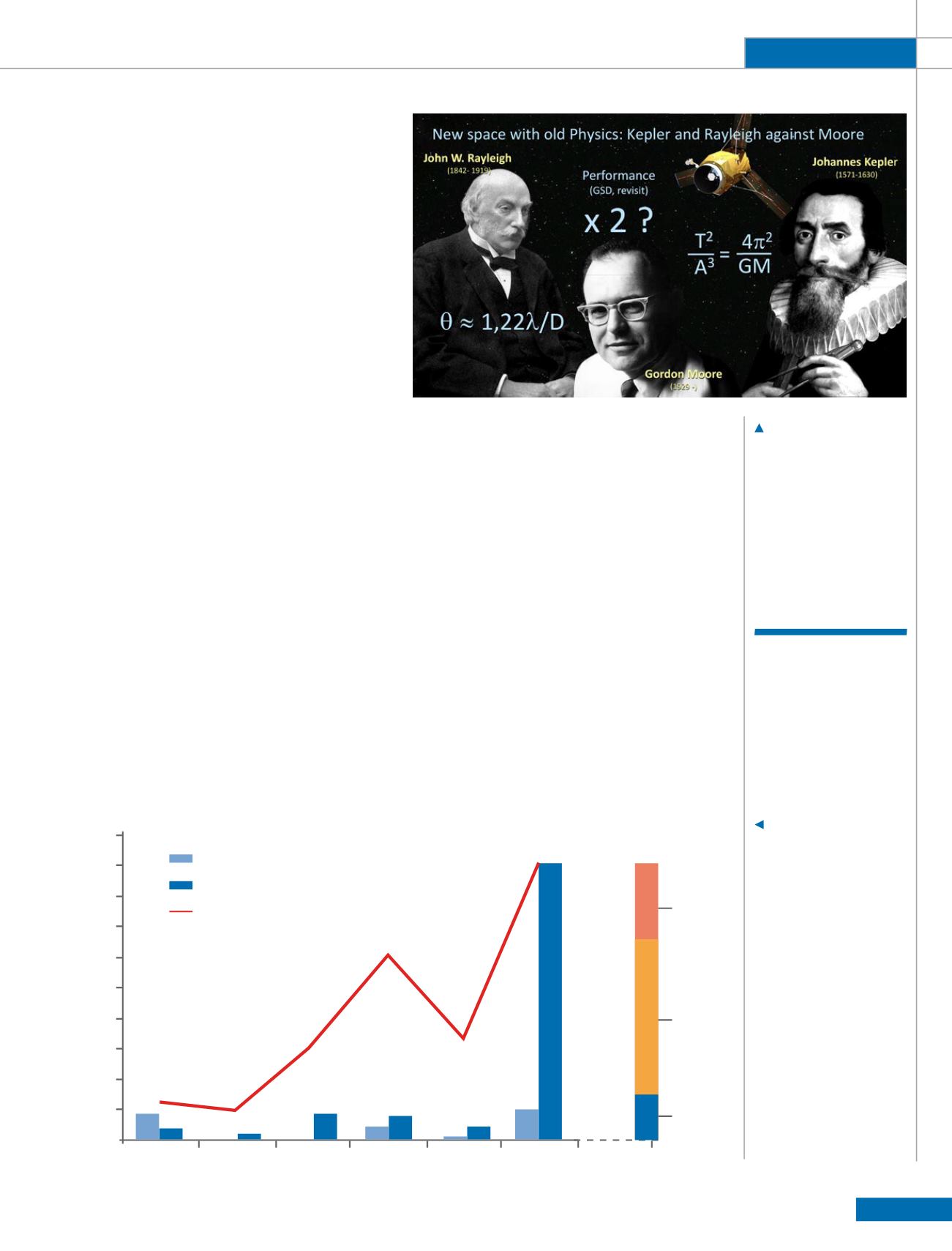

2015 was a record year

for venture capital

investment in space.

Spacetec Analysis/Tauri Group data

2010

2011

2012

2013

2014

2015

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

Seed/Prize/Grant

Venture

Number of Venture Capital Firmen, Incubators and

Accelerators taking part in transactions

Venture Capital 2015

Breakdown

Oneweb

1,814

91

160

186

80

52

180

90

21

208

55

20

19

6

8

37

SpaceX

20

investments

inc.

Astroscale,

Orbital

Insight,

Mapbox and

SpaceFlight

industries

Mil USD