ROOM

31

Special Report

3 and 5 m. While modest in terms of pure

performance (when compared with 0.30 m

resolution from the best commercial satellites),

the main feature of these new initiatives is the

high number of platforms in orbit. This allows

very high revisit rates and makes space sensors

much more reactive than when placed on a few

satellites only.

Terra Bella (formerly Skybox Imaging) plans to

put up a constellation of around 24 satellites in the

next few years. Seven have already been launched

(the last four in September 2016). Their mass is

around 100 kg. They acquire images with a ground

resolution of about 0.90 m.

BlackSky Global, located in Seattle, plans to

put into orbit 60 imaging satellites allowing

a performance of around 1 metre ground

resolution by 2019. Six satellites are under

preparation and the first ‘Pathfinder’ was

launched in September 2016.

UrtheCast, based in Vancouver, plans to serve

the governmental market with its eight optical

and eight radar satellites in preparation. It targets

a high-quality phased optical and radar product

with 0.50 m and 1 to 5 m resolution respectively in

the optical and radar domains (OptiSAR).

In 2015, Planet and Urthecast raised

sufficient funding to acquire the space assets

of established competitors Blackbridge and

DEIMOS, re-enforcing their business model with

a ‘traditional’ satellite constellation and a client

portfolio. These first buybacks are observed

with interest by satellite EO experts and venture

capitalists to understand the dynamic of this

new economic ecosystem.

Many other projects [5] exist as of today,

with different mixes regarding the number of

satellites, mass, complexity and performance,

but with a common objective to reap market

shares using innovative dissemination practices.

Private financing

According to a recent study [6] by Bryce Space

and Technology (formerly Tauri Group), the

space start-ups (all activities included) raised

almost US$13 billion of private investments

between 2000 and 2015. In 2015, a record US$2.3

billion was spent on more than 50 investments

in space start-ups in the US.

Investments by business angels, venture

capitalists or major industrial groups can be

highly rewarding. In the case of Skybox, Google

paid more than US$480 million, while only

US$91 million had been invested in the start-

up by venture capitalists. The benefits for

them were well worth the initial effort. Planet

has been through five rounds of investments,

representing in 2016 about US$206 million

contributed by 17 investors. It recently bought

Terra Bella, highlighting that some consolidation

in this new sector is starting.

US government support

In the US, public institutions support this

new economy. A bit like the early support to

DigitalGlobe, the US government (through the

NGA) has declared many times its enthusiasm

for the NewSpace entrepreneurs in EO.

In 2015, a first initiative known as the

‘NextGen Tasking Initiative’ was announced

to sustain these new commercial activities,

especially to help with the development of new

methods for the collection, processing and

dissemination of commercially generated data.

The global picture is depicted in the

Commercial GEOINT Strategy, published the

same year by the NGA [7]. Six months later,

the creation of an ‘Outpost Valley’ close to

Silicon Valley start-ups was announced with the

reinforcement of the NGA California branch.

More recently still, a new Commercial

Initiative to Buy Operationally Responsive

GEOINT (CIBORG) was publicised with the

explicit goal of supporting the new space

imagery industry for federal users [8]. Terra

Bella, UrtheCast, Planet and BlackSky Global

have been identified as the first potential

interested parties. The first CIBORG contracts

are being signed this year with a budget

increasing over the period 2018-2022.

More and

more

countries are

becoming

active players

in Earth

observation

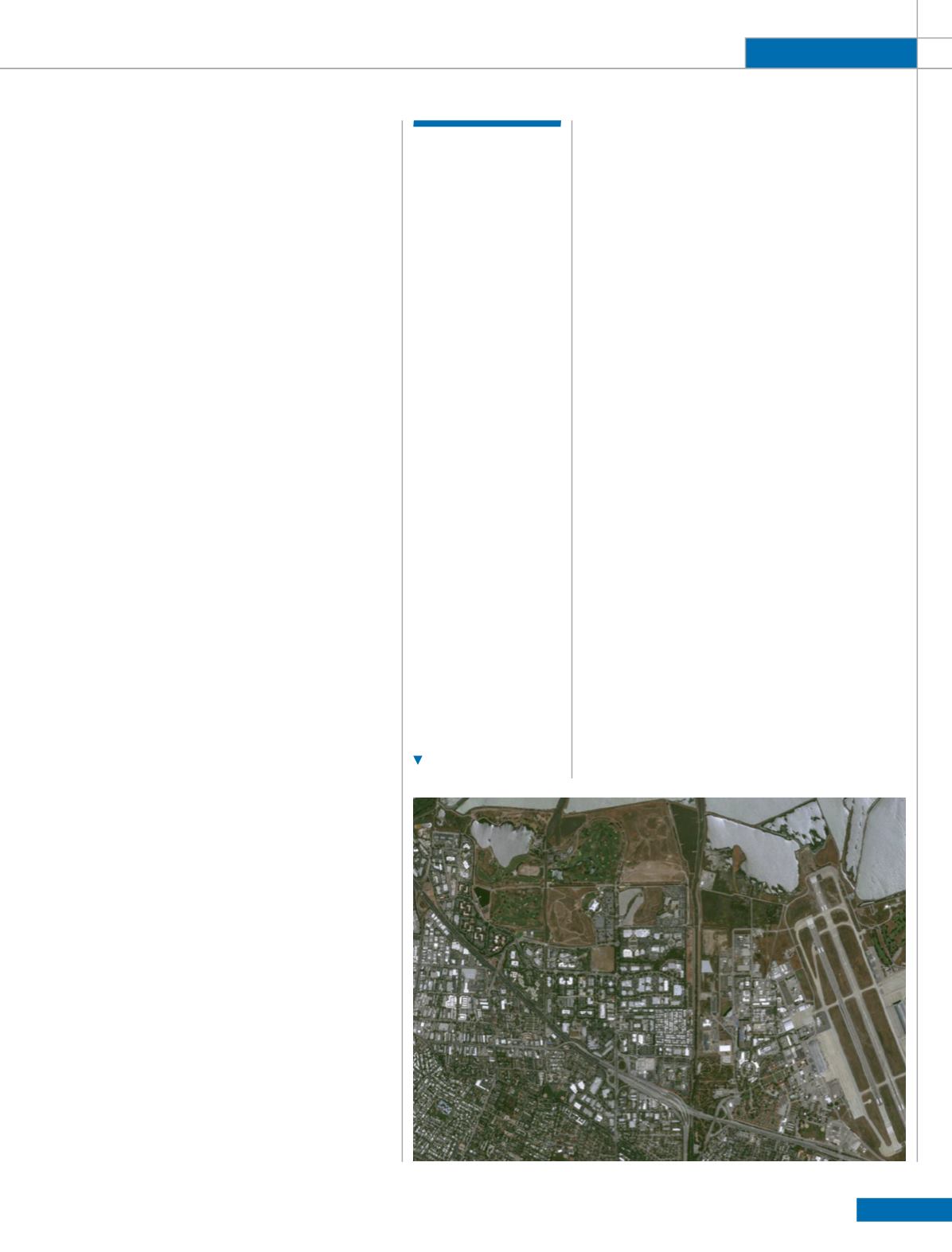

Pleiades image iof the

Silicon valley.

CNES/Airbus DS