ROOM

32

Astronautics

Space without satellites

Some start-ups do not plan to fly their own

satellites: Orbital Insights, based in Palo

Alto, recently received US$20 million in new

investment, including US$5 million from In-Q-

Tel, the investment arm of the US intelligence

community. Orbital Insights gathers its data

through contracts with EO data owners and the

start-up develops software to extract insights

from satellite and aerial imagery.

Another example, SpaceKnow, also based in

Silicon Valley, uses space imagery and other data

sources to track global economic trends through

its Analytics-as-a-Service products. SpaceKnow

SMI (China Satellite Manufacturing Index) is the

first trading index based on satellite data to be

featured on the Bloomberg Terminal.

Next steps

The EO landscape may radically change in the

coming years. While some experts warn about a

possible new internet ‘bubble’, two considerations

moderate the relevance of this analogy.

First, technology has evolved and new

small satellites have improved in terms of

performance/cost and performance/size

ratios. Some (although not all) technological

obstacles tend to disappear or to be of less

crucial importance for the design of space and

ground systems.

Second, comparing support from the web

industry in the 1990s with today gives a clear

indication of the huge progress made and the

financial and industrial strategies regarding

its massive requirements for broadband

telecommunication, location-based services and

information dissemination worldwide.

The usual suspects and the new entrants

implement specific, non-exclusive strategies:

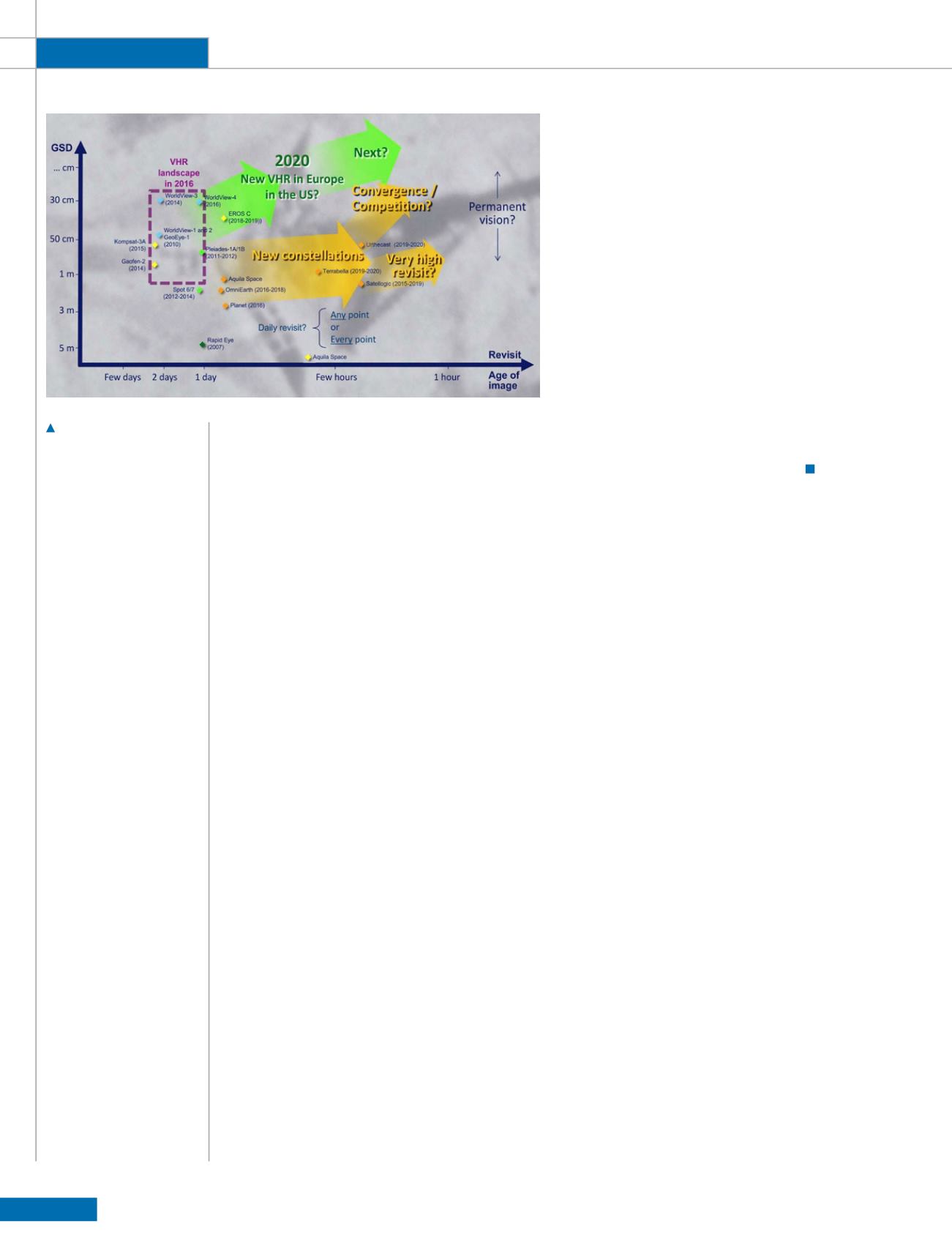

• The ‘high end approach’, with increased

imagery resolution for customers

acknowledging the value of these products:

a significant percentage of revenues come

from EO image value

• The ‘service-based strategy’ is not only

a low-cost approach. It assumes that

the value will be the information and the

services created from the EO data and from

other data sources. The main focus is data

freshness (revisit).

It is too soon to say for sure if the promise

of huge growth in the geoinformation market

fostered by the convergence between IT and

EO will become a reality but EO markets and

the related industrial landscape will evolve

significantly in the coming years and may even

be disrupted by newer technologies.

Acknowledgements

Special thanks to Fabienne Grazzini, Nathalie Pisot, Marie-Christine

Delucq, Rob Postma, Laura-Kate Wilson, Magalie Vaissière (ESA),

David Hello (Terranis), Lionel Kerrelo (Geo4i)

References

1. “Alternative Futures: United States Commercial Satellite Imagery in

2020”, Report prepared for the Department of Commerce by Robert

A. Weber and Kevin M. O’Connell, Innovative Analytics and Training,

November 2011. See

IAT_DoC_Alternative_Futures_Commercial_Satellite_Imagery.pdf

2. “EO embracing the new space environment: the significance

of EO smallsat constellations”, Earth imaging Journal, July 2015,

Euroconsult, Canada, Adam Keith. See

/

print/articles/earth-observation-embracing-the-new-space-

environment-the-significance-of-eo-smallsat-constellations

3. “Des Aliens et des barbares: une révolution dans l’observation de

la Terre”, Thierry Rousselin, Revue Prospective Stratégique, n°45, 1st

trimester 2016.

4. “Satellogic on its way to launching 300 satellite constellation for

EO”. Satellite Today, Caleb Henry, March 2016.

5. “2016: State of the Satellite Industry Report”, prepared by Bryce

Space and Technology (formerly The Tauri Group) for Satellite

Industry Association, June 2016. See:

/

downloads/SIA_SSIR_2016.zip

6. “Start-Up Space: Rising Investment in Commercial Space

Ventures”, Bryce Space and Technology (formerly The Tauri Group),

January 2016. See:

_

Space.zip

7. “Commercial GEOINT Strategy”, National Geospatial- Intelligence

Agency, October 2015, 15 p. See:

/

PressReleases/Documents/2015/NGA_Commercial_GEOINT_

Strategy.pdf

8. “CIBORG Introductory Industry Day”, Slides presented by NGA,

16 June 2026. See

CIBORG%20IndustryDay16Jun2016FINAL%2016-493%20Release%20

%281%29.pdf

Trends in commercial

imagery - resolution

versus revisit.