ROOM

77

Astronautics

have some other value added expertise that can be

helpful to the company.

According to the Angel Capital Association, of

the 8.7 US millionaires there are 265,000 active

angel investors, and 15,000 belong to angel groups.

Angel investing can also be potentially lucrative.

Of the successful angel investment exits, the hold

period was 3.4 years, the investors more than

doubled their money with an average multiple of

2.6 and the internal rate of return (a measure of

the investments success indexed for the time it

was invested) was a whopping 27 percent.

While these returns may seem extraordinary,

they presuppose that the investor is picking

winners. In a portfolio of many investments, several

will yield zero given the high risk of early stage

investments going bankrupt. Consequently, angel

investing is a craft which rewards the experienced

and the knowledgeable, and certainly the fortunate.

NewSpace remains capital constrained. That is

to say, the formation and growth of companies

in the NewSpace sector is limited by its ability to

attract new capital sources to the industry. While

this constraint has been relaxed considerably in

the past few years it still remains an important

limiting factor to the industry’s future growth.

as private equity, the ability for a company to

go public with an IPO (Initial Public Offering)

remains nearly impossible.

Think of the life cycle of capital as a giant

flywheel. It must turn in one direction from

one stage to another continuously and without

skipping portions of the wheel - but at each

revolution (e.g. a public company exit) the next

turn of the wheel becomes easier. In short, a single

IPO could generate enough interest in a sector

to flood it with early stage capital, which leads

to more company formations, more later-stage

growth companies and ultimately another two or

three successful IPOs which then attracts more

early stage capital.

Within all these stages, perhaps the most

important is angel capital. Of 75,000 company

investments in the US in 2015, more than 71,000

were funded by angel capital. Perhaps even more

importantly, of the early stage investments,

roughly 32,000 of the 34,000 were funded by

angel investors.

Typical angel investors are high net worth

individuals who have been successful in another

industry and enjoy investing in starts-ups both for

financial gain but also because they believe they

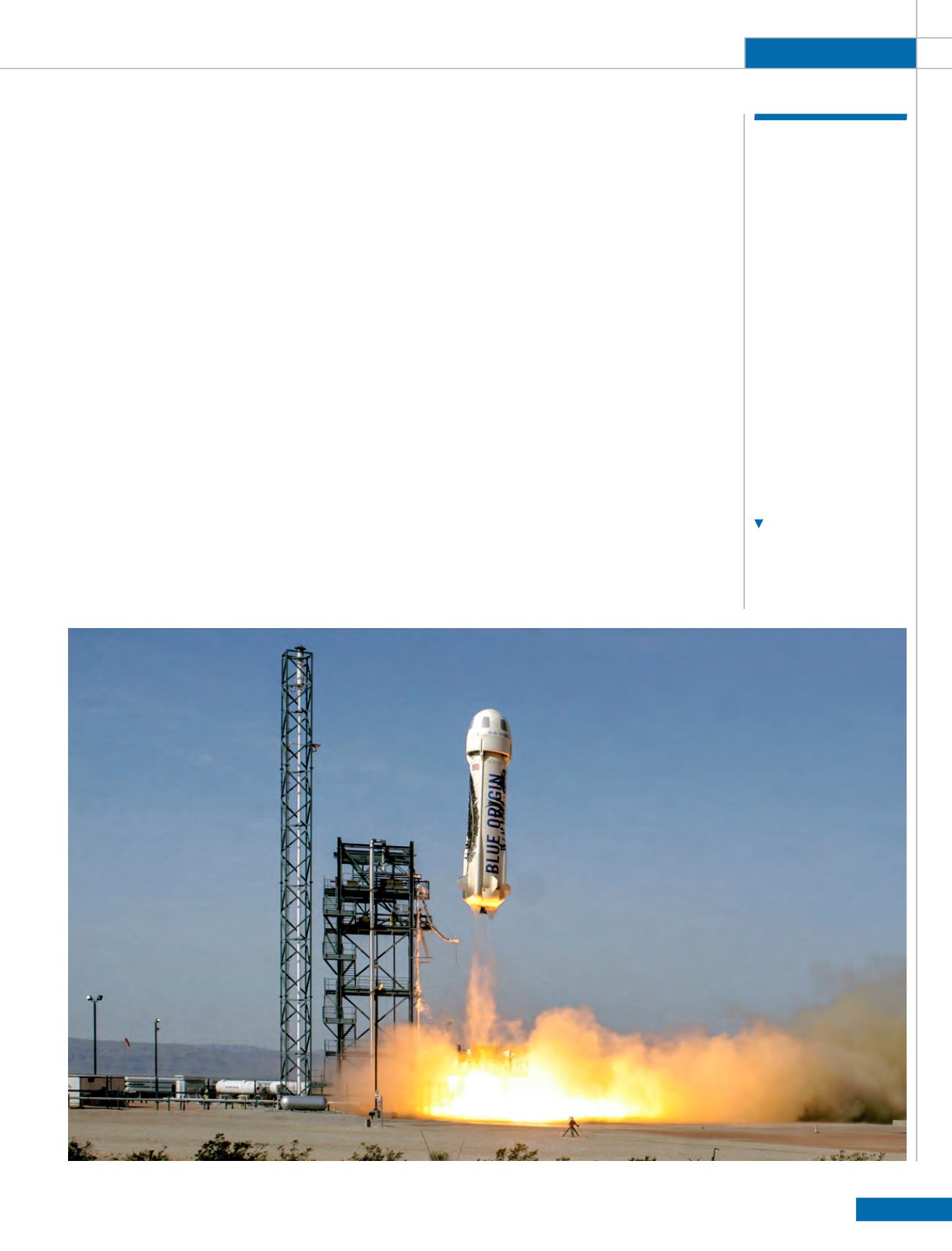

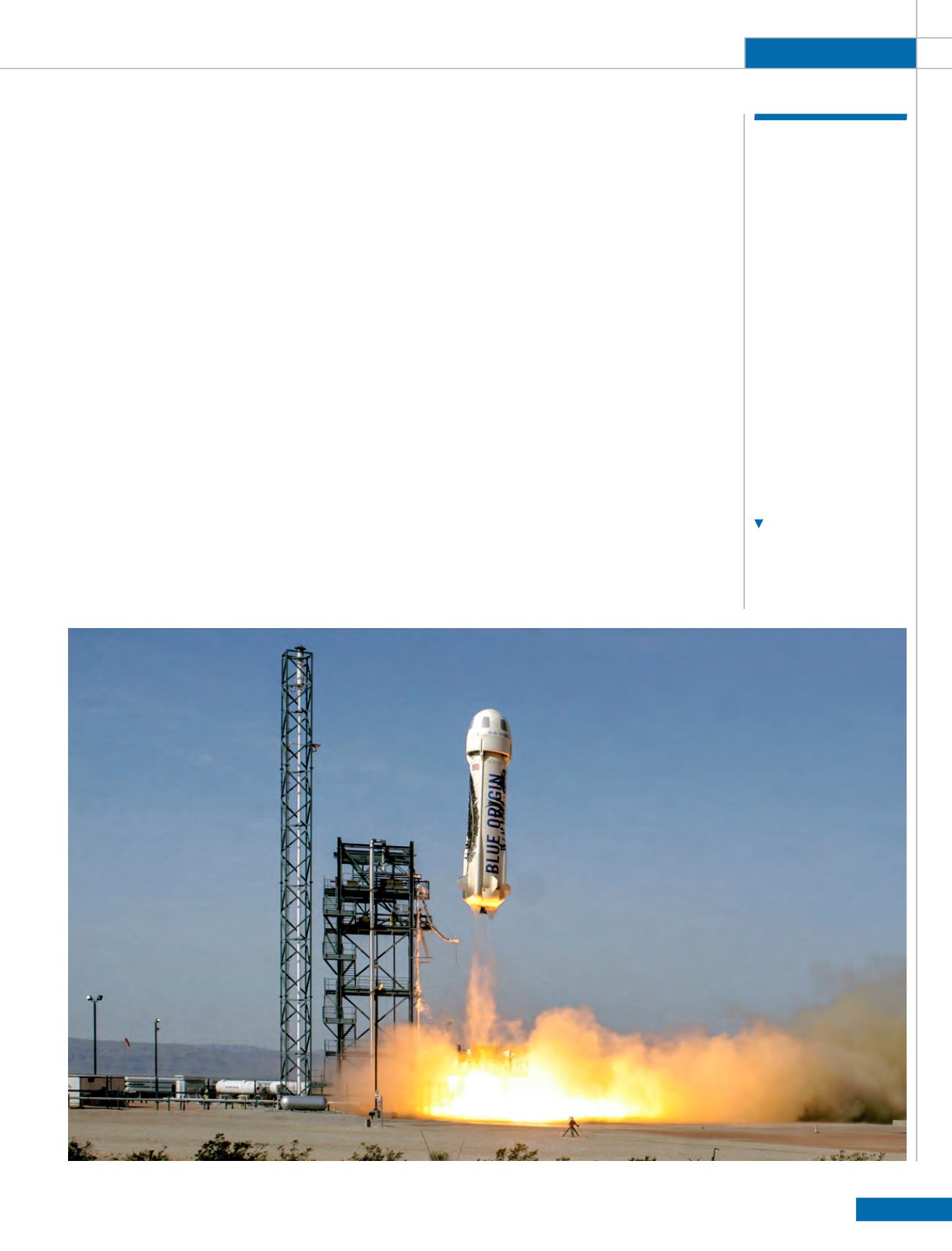

The fourth launch of

Blue Origin’s New

Shepard vehicle before a

successful descent and

landing from a height of

101.0 km on 19 June 2016.

As the

implications

of the ‘mega-

set’ becomes

better

understood,

the amount

of capital

attracted to

the space

sector will

dramatically

increase

Blue Origin