ROOM

76

Astronautics

Silicon valley, California

- home for young

NewSpace companies.

Company financing life

cycle.

previous week’s learnings. This couldn’t be more

different from the linear project management

models used by its competitors which literally lay

out critical paths months or years ahead of time.

As well as SpaceX, however, there are literally

hundreds of new space startups addressing

a multitude of industries and disrupting the

traditional space paradigm.

There are several subsectors with the

NewSpace industry, with several attracting the

bulk of the capital in 2016, including launch

companies and those involved in remote sensing

and communications.

New launch entrants include Vector Space,

Rocket Labs, Blue Origin and Relativity Space,

all of which are attempting to optimise a three

variable value equation: availability, reliability

and affordability.

Any two of the three parameters is not enough

to be successful long term, meaning, for example,

having a reliable and affordable platform is not

valuable if you either have no availability or can’t

predict availability. Similarly, being available and

affordable but being seen as unreliable will not

cut it either. It is for this reason that I disagree

with those who predict a glut of supply for launch

capacity in the near to medium term.

In remote sensing, there has been a huge

explosion in company formations. Notable startups

include Planet, OmniEarth, Audacy, LeoLabs, Spire,

Kepler, OneWeb, Astranis and Analytical Space.

These companies are all racing to build

infrastructure for what has been referred to

as the ‘mega-set’ which will ultimately consist

of a vast hyperspectral data set that is both

persistent (always on) and ubiquitous (covering

the whole Earth).

Such a massive data set coupled with innovations

in machine learning and artificial intelligence could

literally create more value than the entire current

space industry combined. Why? Because with

a data set this vast the amount of products and

services, especially products that are predictive in

nature, are essentially unlimited. My view is that as

the implications of the ‘mega-set’ becomes better

understood, the amount of capital attracted to the

space sector will dramatically increase.

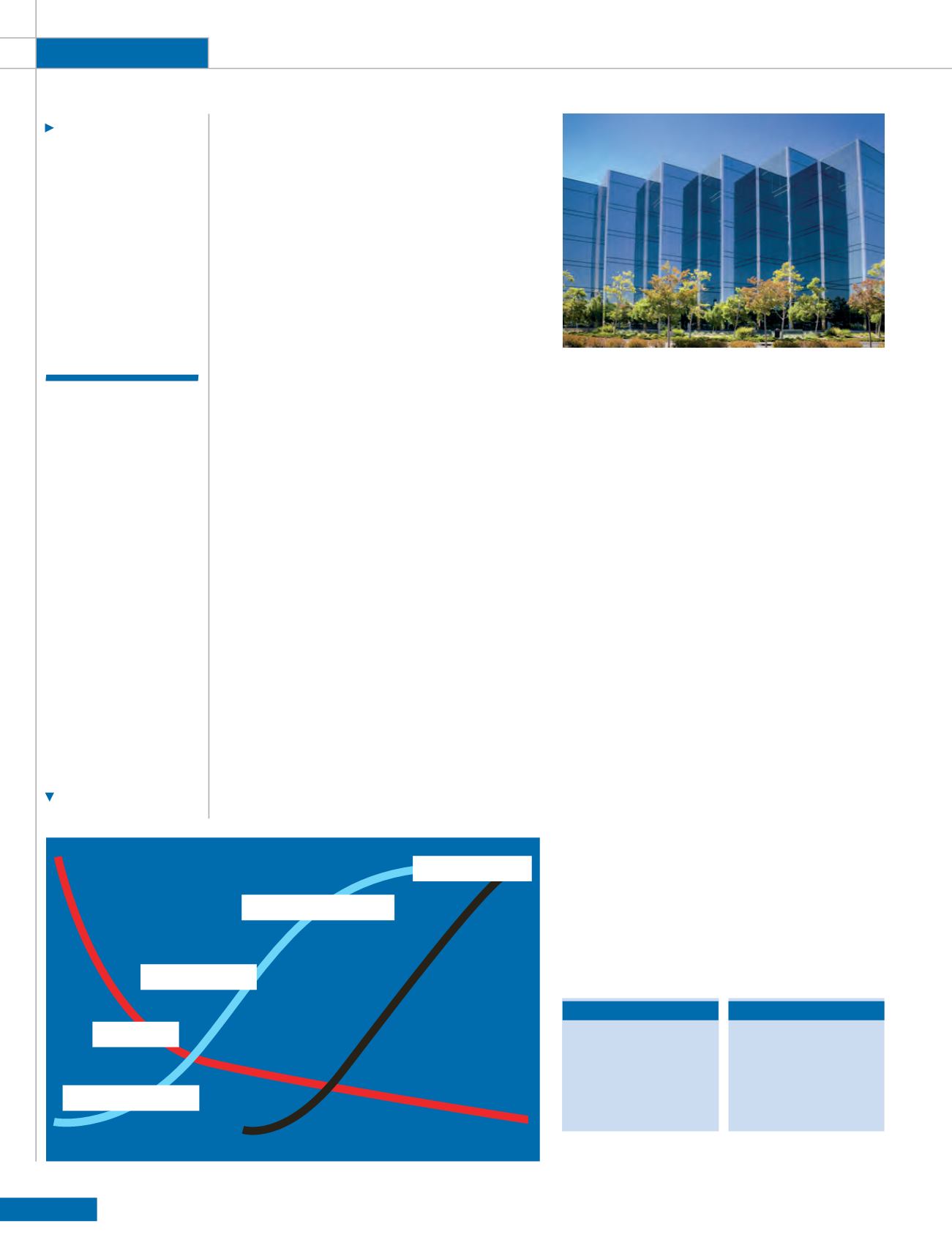

Capital sources

As with all industries that have large numbers of

start-ups, access to early stage capital is critical.

The adjoining graph indicates that capital can

be thought of in stages, starting with formation

capital (typically friends and family) to so-called

angel investors, private equity and venture capital

and then, ultimately, public markets.

These capital sources are essentially

sequential and cumulative in the sense that each

stage requires successful deployment of capital

at an earlier stage. For example, if sufficient

capital isn’t attracted at the friends and family

round, the ability to create a proof of concept

and/or an initial product or service that will

attract angel capital could be impacted.

Without angel capital, the ability to generate

client traction and revenue could be impacted

which would likely prohibit the ability to raise

venture capital and without successful venture

capital and other sources of growth capital such

NewSpace

companies are

characterised

by a

scrappiness

and mentality

which is

distinctly

associated

with Silicon

Valley start-

ups

PUBLIC

RISK

SALES

INVESTMENT

VENTURE CAPITAL

SEED CAPITAL

ANGELS

GRANTS/F&F$

ANGEL INVESTORS

• $24.6 billion

• 71,000 deals

• 17,750 seed

• 31,950 early stage

• 19,170 expansion

• 305,000 individuals

VENTURE CAPITAL

• $59.1 billion*

• 4,380 deals

• 186 seed

• 2,219 early stage

• 1,975 later/expansion

• 718 active firms

* Sources “Angel investing Market for 2015, Centre for Venture

Research/ UNH; NVCA 2016 Yearbook; PwC Money Tree

Primaxis Technology Ventures