ROOM

95

Opinion

On 21 March 2017, the Space Industry Association

of Australia (SIAA) released a white paper ‘Advancing

Australia in Space’, in which it asserted that the

Australian space sector could, with the ‘right impetus’,

double its current annual revenues of approximately

US$2.5 billion (about 0.8 percent share of the global

space economy) within five years and that four

percent global market share could be a realistic goal

within 20 years. The ‘right impetus’ would be “the

establishment of an Australian Space Agency to lead a

cohesive national space strategy” [4].

Civil space leadership

The SIAA white paper has been presented to the

Minister for Industry, Innovation and Science for his

consideration [5]. Although responsibility for specific

aspects of space activities is disparate throughout

Australian government, the Department of Industry,

Innovation and Science is responsible for civil

space issues and is the central point of contact and

coordination for the government’s involvement in

national and international civil space activities.

That responsibility is manifested in a small

number (less than 10) of dedicated staff in an

office known as ‘Civil Space and Cyber Security

section’ - a far cry from a fully-fledged space

agency. The department also has responsibility for

administering legislative arrangements regulating

Australian civil space activities to ensure these

activities do not jeopardise national interests and

Australia’s “international obligations” in space, as

well as for policies that provide the right conditions

for entrepreneurs and businesses to innovate and

capitalise on their space-related activities [6].

Even before the release of the SIAA white paper,

the department recognised that it reflected a theme

that has been developing within Australia for more

than a decade - that the legislation administered

by the department, namely the Space Activities Act

1998 and its subordinate legislation, is not adapted to

providing “the right conditions for entrepreneurs and

businesses to innovate and capitalise on” significant

and growing opportunities for Australian space

industry to contribute to the global space economy.

A reviewof the Space Activities Act 1998 and its

subordinate legislation, initiated inOctober 2015, has

been completed and the department is nowconsidering

legislative changes with a draft bill expected in the

second half of the year [7] around the time of IAC 2017.

The timing is therefore ripe for a significant

evolutionary change in the Australian space

industry and while IAC 2017 represents a great

opportunity to announce such a change, we will

just have to wait to see what the Department of

Industry, Innovation and Science will decide.

Defence space leadership

While the Department of Industry, Innovation

and Science has overarching responsibility for

civil space issues, by far the biggest proportion

of Australian government funding for Australian

space activities is through the Department of

Defence.

So it follows that defence could play a larger

part than any other sector in providing the ‘right

impetus’ for a national space strategy and the

growth of the Australian space industry. Such

growth implies not just additional civil capability,

but also access for defence purposes to a greater

level of sovereign space capability than Australia

has ever previously had.

Australia relies heavily on its relationship with

the United States for access to space infrastructure

and space services. Like other western nations,

the ubiquity and increasing dependence on space-

SPACE SPENDING

The Australian Department of Defence does not aggregate its budget figures

under the heading ‘space’ or similar, so it is difficult to say how much of the

Department’s overall budget is spent on space.

Nevertheless, some indication of the scale of defence funding on space is

available through a report released in 2015 by Asia Pacific Aerospace Consultants

for the Department of Industry, Innovation and Science entitled ‘A Selective

Review of Australian Space Capabilities: Growth Opportunities in Global Supply

Chains and Space Enabled Services’.

It involved a study of 46 companies indicative of the Australian space industry as a

whole, and within that selection, 72 percent had defence as a customer.

The figure represents only the money defence spends on space through

commercial space activities in Australia and does not take into account

commercial space services sourced from outside Australia and money spent

internally within defence on space.

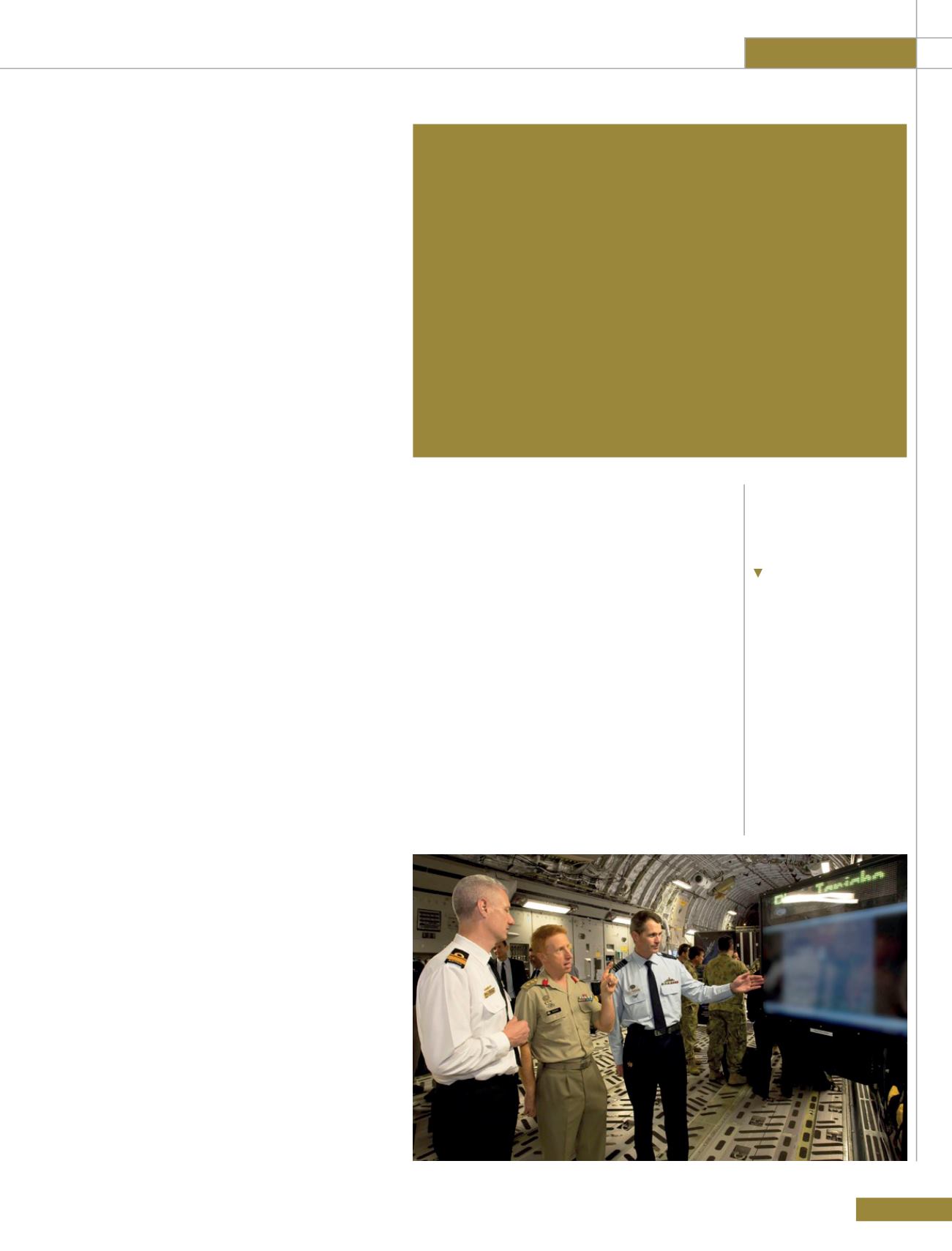

Royal Australian Air

Force C-17A Globemaster

with a new advanced

satellite communication

and imagery display

system - a concentration

of military forces in an

area necessarily implies

an extraordinary demand

for satcom bandwidth,

precise Position,

Navigation and Timing,

and remote sensing data.

New capabilities, offering

greater connectivity, are

increasing that level of

extraordinary demand.